How to Grow Your Landscaping Business Fast When Cash Is Tied Up — A Real-World Way to Get Working Capital

Disclosure up front: I’m being paid to promote Revenued. I always tell you the straight truth — I only share tools I’d use on my own crews.

You’re busy. Jobs are booked. But every time a great deal on a mower, trailer, or crew shows up, your money’s tied up in supplies, payroll, or deposits. That’s the number one thing that kills growth for small landscaping outfits: cash flow.

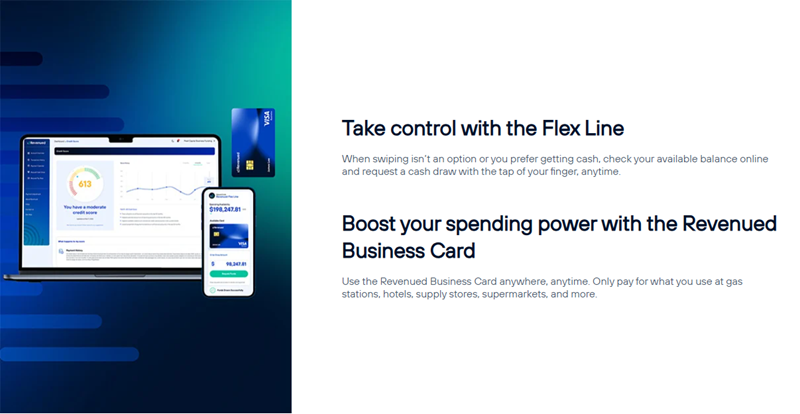

I’ve been where you are. You don’t need more debt on your personal credit. You need working cash when you need it. Revenued’s Flex Line and the Revenued Business Card give you quick access to funds based on how your business is doing — not your personal credit score. Approvals can happen in as little as an hour, and you can access funds within 24 hours. That kind of speed matters when gear, materials, or an opportunity shows up and you gotta move fast.

Why this matters to landscapers (the short list)

- Gear matters: That commercial mower or trailer can turn two jobs into four.

- Jobs wait for nobody: If you wait to pull cash from the bank it might be gone.

- Payroll and deposits: You gotta pay crews and buy supplies before customers pay — every week.

- No credit? No problem: This looks at your business revenue, not your credit score.

What the Flex Line actually does (plain and simple)

Revenued’s Flex Line is business funding that grows with your revenue. You apply online, Revenued looks at your business deposits and performance, and if you qualify you get a flexible amount to use. You can draw funds into your business bank account or use the Revenued Business Card where Visa is accepted.

Some things that make sense for landscapers:

- Buy that used commercial mower that won’t last long on the market.

- Grab a trailer or dump trailer when you see a steal.

- Pay your crew while you wait on big invoices.

- Buy materials for a big job now and get paid later.

What it costs and how payback works (so there’s no surprises)

Revenued doesn’t call this a loan. They don’t call it a credit card. They call it a Flex Line and a payback amount applies to funds you use. The company uses factor rates (typical range noted is 1.1–1.5 in materials provided), and terms are usually 6–12 months. It happens on a schedule (daily or weekly) tied to what you use.

Important: Don’t confuse that with “no cost.” There’s a set payback amount for the funds you use. But there are no application fees, no maintenance fees, and no origination fees — and approvals are based on business revenue and bank deposits, not your personal credit score.

How this plays out in real life — one example

You spot a used commercial zero-turn mower that will last for seasons. It’s priced right and would let you add a crew. Problem: your cash is on two other job deposits. With Revenued, you apply, get a quick decision, and either draw the funds to your bank or use the Revenued Business Card to pay the seller. You use the mower, run more jobs, and the increased business helps cover the payback amount over the next months. Simple.

Who qualifies (the basics)

- 1+ years in business (not for brand-new startups).

- A separate business bank account with at least 3 months of activity.

- Minimum ~$20K/month in deposits (this is a guideline — some industries and profiles vary).

- US-based businesses mostly in construction, landscaping, and similar fields do well.

Why Revenued is different from bank loans or personal cards

- Speed: Decision in as little as 1 hour; access to funds within 24 hours.

- Based on revenue: They look at your business deposits and performance, not just FICO.

- No personal-credit focus: You can qualify even with less-than-perfect personal credit.

- Real support: You get a U.S.-based account manager to help after approval.

- Built for business use: Use it for supplies, payroll, gear — wherever business cash is needed.

What I’d use the money for on day one

If it were my crew, I’d prioritize:

1) Replacing or upgrading broken gear (mowers, blowers, trailers).

2) Paying crew so you don’t lose good people.

3) Buying materials for a big seasonal job that pays well.

4) Seizing quick deals on equipment that go fast.

A quick real one-line testimonial from a real user

“Regi was outstanding! He explained everything to me about the entire process as I was unfamiliar with this type of financing. He was very patient with me and made me feel comfortable! I would highly recommend this company.” — real Revenued account holder

How to avoid mistakes when you use working capital

- Don’t buy stuff you don’t need. Use the money for revenue-driving items.

- Match term to use: don’t use short-term draws for long-term purchases.

- Keep track of daily/weekly payback schedules so your bank account stays healthy.

- Talk to your Revenued account manager — they’ll help you plan.

Weapons-grade checklist — how crews should use Revenued funds without screwing it up

1) Write down the exact reason for the draw before you pull funds

- New mower? Payroll? Materials for Job X? If it’s not on the list, don’t touch it.

2) Do the math first

- Figure the purchase price, estimated extra revenue the gear will bring, and the payback amount. If the extra revenue doesn’t clearly cover the payback and keep your bank balance safe, don’t pull the funds.

3) Keep a separate “project” bank line in your ledger

- Track funds you pulled and what they paid for. Don’t mix the numbers with regular deposits. Make it simple: date, amount, purpose.

4) Match term to use

- Short-term needs (materials, payroll) should be covered with short-term draws. Bigger purchases that help you make more money right away (like a mower that lets you add a crew) are OK — but have a plan to cover the payback schedule.

5) Set aside a weekly buffer

- Because paybacks are daily/weekly, keep a 1–2 week payroll buffer in the bank so automatic paybacks don’t mess you up.

6) Use the Revenued account manager

- Talk to your account manager before you pull big funds. They can help structure draws and timing.

7) Buy revenue-driving items first

- If you pull funds, spend them on things that make money back faster (gear that increases capacity, materials for high-margin jobs, or keeping crews paid so you don’t lose them).

8) Check the factor rate and schedule before you sign off

- Know the payback amount and frequency. Write those numbers on the draw paperwork and in your ledger.

9) Communicate with your crew

- Tell your crew what you pulled funds for and how it helps the business. Keep them in the loop so they don’t panic when paybacks start.

10) Review results after 30 days

- Did the draw do what you expected? Track extra revenue and compare to the payback amount. If it worked, repeat carefully. If it didn’t, learn and don’t repeat that mistake.

Step-by-step — how to apply (so you can do it fast)

1) Go to the application page (I’ll show the link below).

2) Have your business bank statements and basic info ready (DBA, business bank account).

3) Apply online — you can get a decision in as little as an hour.

4) If approved, you’ll get access to the funds (bank deposit or Revenued Business Card) within 24 hours.

5) Use the funds for gear, payroll, or materials and monitor the payback schedule.

What I like about it

- Quick access if you need to move fast on gear or supplies.

- No nonsense setup: no annual or maintenance fees.

- Helpful support from a real person after approval.

- It treats your business performance like the signal — not your personal credit score.

What to watch out for

- Factor rate and payback amount: make sure you know the exact numbers before you pull funds.

- Daily/weekly payback: if you have thin bank balances, plan around the cadence so you don’t bounce payroll.

- Qualifications: not for brand-new startups — you’ll need some business history and deposits.

If you want to move faster on equipment or payroll

If you’re a landscaper who’s ready to act fast on gear, protect payroll, or seize a big job, check if you qualify. Apply and you can get a funding decision in as little as an hour and access funds within 24 hours.

Check it out by clicking right here

Final word — keep growing, not stressing

Running a landscaping business is about finding the right hires, showing up early, and having tools that work. Cash flow shouldn’t be the thing that slows your growth. If your schedule is booked and your gear is barely holding up — or if you need fast access to funds for a big opportunity — this is a legit option to consider.

Remember: I’m being paid to promote Revenued. I only promote tools that can move the needle for crews like ours.