How to Keep Your Personal Expenses Low as a Small Business Owner

As a small business owner, every dollar counts. After you initially get your business off the ground, it can be tempting to start buying all sorts of toys that you have always wanted. However, items that you buy that are not going to make you money, are huge liabilities for owners of a young small business. While you may be able to afford it this month, who knows what will happen next month.

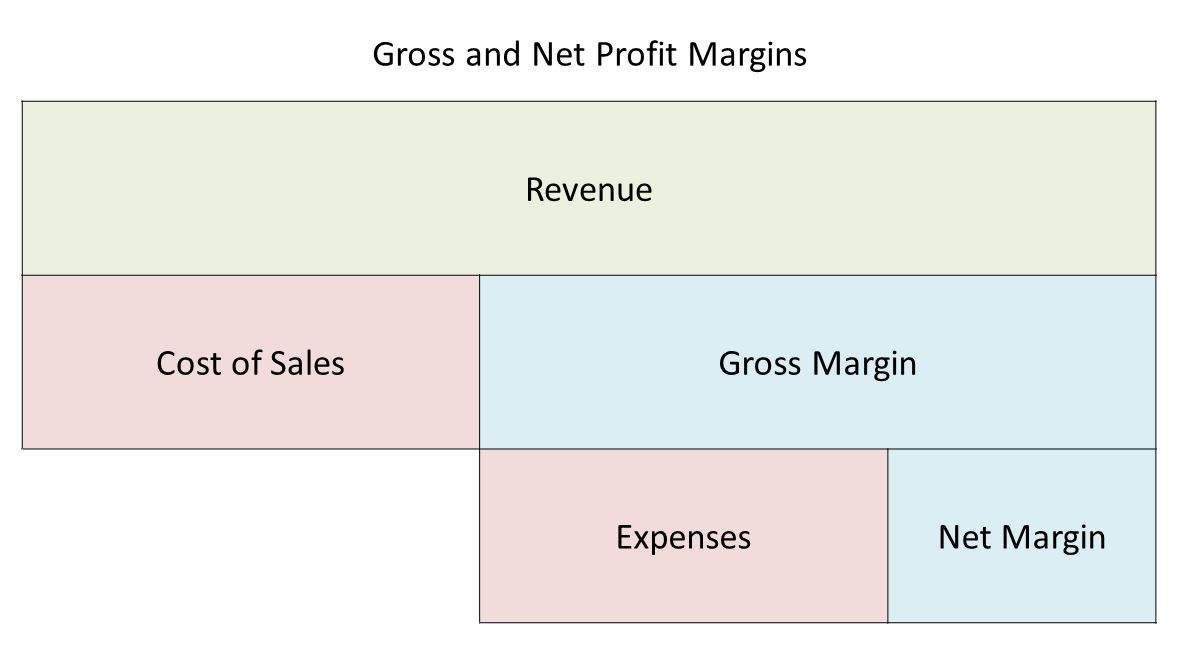

Typical Profit Margins

If you are running a basic small business, you already know that there are tons of expenses that you need to keep up with. You have to pay for materials, labor, taxes, gas, and countless other things. All of these things add up and eat away at your profits.

Typically the average small business makes about 20% net profits. So if they are doing a $5,000 job, they make $1,000 in profit after they pay everyone else. 20% profit margins are honestly pretty good. Many businesses make much less than that. Owners of larger businesses can make as little as 3-5% net profits after all is said and done.

What Your Assets Really Cost

You may be able to see where I am going with this. Say you want to buy a new camper for your family. Sure campers are awesome, and you are going to have a great time using it. Although that camper comes with a $1000 a month payment.

You may be thinking, sure I can make that payment no problem. However if you are making 20% profits on your business, that $1000 payment is really a $5000 job. So does the camper cost $1000 a month? No, it is actually costing your business $5000 a month.

That means whatever your business is already making per month, you have to find an extra $5000 job just to make up for that payment. That means your business has to make an extra $60,000 a year just for you to afford the payment on your shiny new camper.

Now let me get something straight, if you are buying an asset that is going to help your business then the cost may be worth it. For example, you buy a new mower, truck, or trailer. If these things are helping your business perform better, then it is a whole different conversation.

Stay Humble as Long as Possible

After a few years of figuring out your business, you are likely making plenty of money. That does not mean that you should go spend it on dumb stuff. A sum of money in a bank account seems to be too much to handle for many people. Especially if you have never had as much money as you currently do.

My advice is to be as humble as possible with your money. Don’t get me wrong, you should not be eating ramen noodles anymore, but you also should not be eating porterhouse steaks every night either.

If you are just looking for something to do with your money, I always suggest you invest it. You can invest into your own business in hundreds of ways. You can buy more equipment, spread to a new area, hire more workers etc. You can also just invest it into the market or real estate.

You want to get your money working for you. Investing is the best way to do that. Buying things you can live without is just going to bring back all the financial stress you worked so hard to get rid of.

A Million Dollar Business That Barely Gets by

I was once listening to a podcast that was interviewing someone who owned a business that made over a million dollars a year. You would think that the owner would definitely be doing well and is making a ton of money. However, that was not the case.

This guy said he was eating peanut butter and jelly sandwiches just to get by and his business makes over a million a year!! That just goes to show that just because your business is making a ton does not mean you can afford all of the nice toys you want at home.

Keep your head down and grind until your business is making plenty enough for you to have what you want, or else you will just wind up as financially strapped as you were when you started your small business.